Why Choose Helix?

Private Markets Fund Research can be a

time consuming process...

Sorting through thousands of available funds across disparate data sources to source new opportunities

Researching new managers or funds across PPMs and tedious offering documents

Generating reports and answering questions for advisors, clients and Investment Committees

...But it doesn’t have to be

Helix by HL is the world’s first natural language, generative AI co-pilot designed specifically forPrivate Markets, making arduous research a thing of the past.

With Helix, you can:

- Source your product shelf faster

- Instantly answer question from Advisors and IC members

- Generate investment memos

Helix, the pioneering AI co-pilot for private markets, is designed to empower Chief Investment Officers (CIOs) by simplifying and enhancing the management of private market investments.

Developed through a joint venture between TIFIN and Hamilton Lane, Helix integrates advanced AI technology with exclusive data, providing CIOs with the tools needed to optimize investment strategies and drive superior performance.

Source and Manage

Your Product Shelf

Faster With Helix

Strategic Insights

Access data-driven insights that inform and enhance your investment strategies.

Efficient Due Diligence

Streamline the due diligence process, reducing the time and effort required to evaluate investment opportunities.

Enhanced Decision-Making

Utilize Helix’s AI capabilities to make more informed and strategic investment decisions.

Comprehensive Data Integration

Leverage Hamilton Lane’s premium data alongside your proprietary data for a holistic view of the market.

Conduct analysis on funds in

our database, or add your own

Manager Details

- Partner information

- Investment Team details & Bios

- Track Record

Fund Details

- Investment Objective & Strategy

- Target Sizes/Caps

- Industry/Sector

- Liquidity profiles

- Investment Periods

Terms - Fees, Carry, Expenses

- GP/LP Commitments

Portfolio Details

- Holding period

- Investment exposures

- Investment Targets

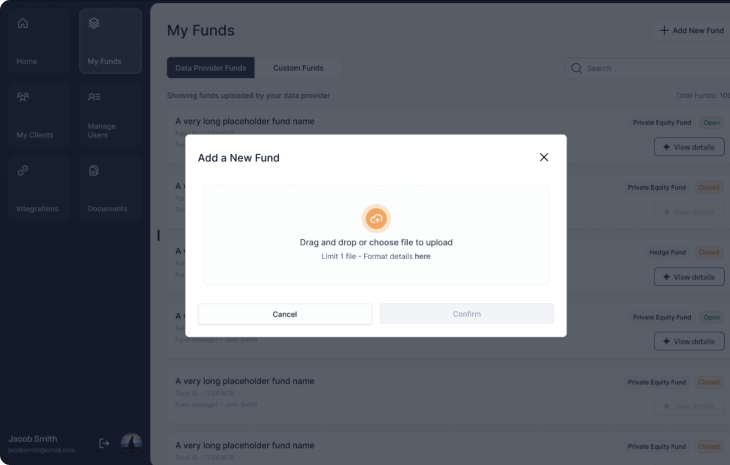

Custom document upload functionality makes it easy to overlay Helix’s AI capabilities onto any fund PPM or marketing document

Features

Real-Time Fund Information:

Instantly access detailed information about funds, including offering documents, sales materials, and structured data, through Helix’s AI-powered platform.

Custom Document Upload:

Upload and analyze your fund’s PPMs and marketing documents, allowing Helix to extract and summarize key information quickly and accurately.

Intelligent Query Responses:

Get real-time answers to complex questions about funds and private market investments using Helix’s natural language processing capabilities.

Tailored Communications:

Generate customized emails and reports to communicate effectively with stakeholders and investment teams.

Use Cases for CIOs

Portfolio Optimization:

Helix assists CIOs in optimizing portfolio allocations by providing insights into the performance and risk profiles of various private market investments.

Enhanced Reporting:

Generate detailed and customized reports for stakeholders, providing clear insights into investment strategies and performance.

Streamlined Due Diligence:

Simplify the due diligence process with Helix’s AI capabilities, enabling quick and thorough evaluations of potential investments.

Real-Time Market Analysis:

Stay ahead of market trends with real-time data integration and analysis, ensuring timely and strategic investment decisions.

How It Works

Step 1

Intent Recognition:

Helix identifies the user intent behind each query, routing it to the appropriate intelligence engine for further interpretation.

Step 2

Intent Mapping:

The identified intent is mapped to the relevant data and insights, ensuring accurate and targeted responses.

Step 3

Response Generation:

Helix generates responses based on real-time data and analytical research, providing advisors with actionable insights and recommendations.

Learn More

Discover how Helix can transform your investment strategy.

Contact us for a demo or more information.

"*" indicates required fields