Helix for RIAs:

Elevate Your Practice with Intelligent Private Markets Solutions

Why Choose Helix?

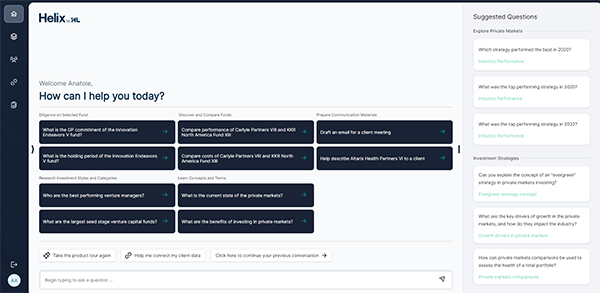

Helix is designed to address the unique challenges faced by RIAs in incorporating private market investments. By leveraging advanced AI technology, exclusive data, and a robust compliance framework, Helix empowers advisors to enhance their practice, provide superior client service, and achieve better investment outcomes.

Selecting alternative investments

can be a complex process…

Locating and sorting through available or approved funds across disparate data sources to source new deals

Researching new managers or funds across PPMs and tedious offering documents

Generating memos and answering questions about Alts for clients

...But it doesn’t have to be

Helix, a cutting-edge AI assistant developed through a joint venture between TIFIN and Hamilton Lane, revolutionizes how Registered Investment Advisors (RIAs) incorporate private market investments into client portfolios.

Helix simplifies the complexities of private markets investing, empowering advisors to confidently offer diverse investment opportunities to their clients.

Identify Investment

Opportunities Faster

Data-Driven Insights

Helix provides access to premium, exclusive data from Hamilton Lane and other top data providers, ensuring advisors have the most comprehensive and accurate information available.

Enhanced Decision

Making:

Utilizing advanced Generative AI tools, Helix streamlines complex workflows, enabling advisors to conduct thorough research and analysis quickly and efficiently.

Personalized and Compliant

Helix’s intelligent engine tailors recommendations and insights to each advisor’s unique needs, while integrating compliance at every step to ensure adherence to regulatory standards.

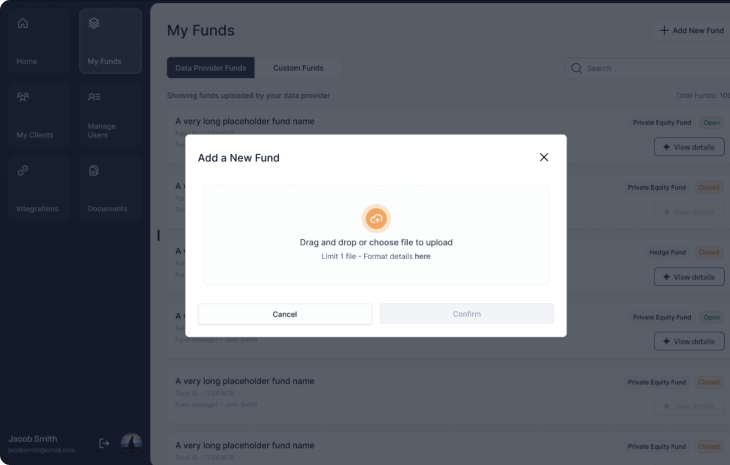

Conduct analysis on funds in

our database, or add your own

Manager Details

- Partner information

- Investment Team details & Bios

- Track Record

Fund Details

- Investment Objective & Strategy

- Target Sizes/Caps

- Industry/Sector

- Liquidity profiles

- Investment Periods

Terms - Fees, Carry, Expenses

- GP/LP Commitments

Portfolio Details

- Holding period

- Investment exposures

- Investment Targets

Custom document upload functionality makes it easy to overlay Helix’s AI capabilities onto any fund PPM or marketing document

Features

Intelligent Engine:

Powered by domain-specific data analytics, proprietary information, and TIFIN’s IP framework, Helix delivers actionable insights and personalized recommendations.

Real-Time Data Integration:

Helix integrates real-time data into text responses and analytical research, ensuring advisors always have up-to-date information.

Expert Workflows:

From investment memos to manager diligence, Helix provides templates and capabilities to streamline complex documentation processes.

Private Markets Knowledge Base:

A vast repository of information covering a wide array of topics related to alternative investments, supporting both education and strategic decision-making.

Use Cases for RIAs

Portfolio Diversification:

Helix assists RIAs in identifying, evaluating, and allocating more clients to diverse alternative investment opportunities, from private equity to real estate, helping to build robust and diversified client portfolios.

Enhanced Decision-Making:

With access to cutting-edge AI-driven insights and real-time data, RIAs can make more informed decisions, improving the overall performance of client portfolios.

Client Engagement and Education:

The platform’s educational tools and comprehensive data resources empower RIAs to educate their clients about the benefits and risks associated with private markets investments, fostering deeper client relationships.

Compliance Management:

Helix’s integrated compliance features ensure that all investment activities are conducted within regulatory frameworks, reducing the risk of non-compliance.

How It Works

Step 1

Intent Recognition:

Helix identifies the user intent behind each query, routing it to the appropriate intelligence engine for further interpretation.

Step 2

Intent Mapping:

The identified intent is mapped to the relevant data and insights, ensuring accurate and targeted responses.

Step 3

Response Generation:

Helix generates responses based on real-time data and analytical research, providing advisors with actionable insights and recommendations.

Learn More

Discover how Helix can transform your practice.

Contact us for a demo or more information.

"*" indicates required fields